Introduction

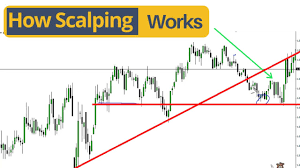

In the fast-paced world of foreign exchange (Forex) trading, various strategies exist to capitalize on market fluctuations. One such strategy, Forex scalping, has gained popularity for its ability to exploit short-term price movements for quick profits. This article delves into the intricacies of Forex scalping, exploring its definition, techniques, tools, and psychological aspects to help traders develop a successful approach.

What is Forex Scalping?

Forex scalping is a trading strategy characterized by executing numerous trades within a short timeframe, typically holding positions for seconds to minutes. Scalpers aim to profit from small price movements, relying on high trading frequency and tight spreads to accumulate gains over time. Unlike traditional trading methods focusing on long-term trends, scalping capitalizes on rapid market fluctuations, making it suitable for traders with a high risk tolerance and a preference for quick trades.

Indicators for Forex Scalping

Moving averages are versatile indicators that offer several applications in Forex scalping:

- Trend Identification: Moving averages help scalpers identify the direction of short-term trends. When the price is above the moving average, it suggests an uptrend, while a price below the moving average indicates a downtrend. Scalpers often focus on trading in the direction of the prevailing trend to increase the probability of successful trades.

- Entry and Exit Points: The crossover of moving averages can signal potential entry and exit points. For example, a bullish crossover, where a shorter-term moving average crosses above a longer-term one, may indicate a buy signal, suggesting an upward momentum in price. Conversely, a bearish crossover, where a shorter-term moving average crosses below a longer-term one, may signal a sell opportunity as downward momentum strengthens.

- Dynamic Support and Resistance: Moving averages act as dynamic support and resistance levels, helping traders identify key price levels where the market is likely to reverse or continue its trend. During an uptrend, the moving average may act as a support level, providing buying opportunities when the price retraces to the moving average. Similarly, during a downtrend, the moving average may serve as a resistance level, offering selling opportunities as the price approaches the moving average from below.

- Confirmation of Price Action: Moving averages can confirm price action signals generated by other indicators or trading patterns. For example, a bullish reversal pattern combined with the price crossing above a moving average may strengthen the bullish bias, providing scalpers with added confidence in their trade decisions.

While moving averages offer valuable insights into short-term price dynamics, it’s essential for scalpers to consider their limitations and incorporate additional indicators or tools for comprehensive analysis. Moreover, adapting moving average settings to suit different market conditions and currency pairs can enhance their effectiveness in Forex scalping strategies. By leveraging moving averages alongside other technical indicators, scalpers can refine their trading approach and capitalize on short-term trading opportunities in the Forex market.

The advantages and disadvantages of Forex scalping

Forex scalping, like any trading strategy, comes with its own set of advantages and disadvantages:

Advantages:

- Quick Profits: One of the primary attractions of Forex scalping is its ability to generate rapid profits. By capitalizing on small price movements, scalpers aim to accumulate gains over multiple trades within a short timeframe. This rapid turnover can lead to a steady stream of profits for skilled scalpers.

- Reduced Exposure to Market Risks: Scalping trades are typically held for very short durations, often just a few seconds to minutes. As a result, scalpers are less exposed to overnight risks, such as unexpected market gaps or geopolitical events. By closing positions before the end of the trading day, scalpers can mitigate the impact of external factors on their trades.

- High Trading Frequency: Scalpers thrive on high trading frequency, executing numerous trades throughout a trading session. This frequent activity allows scalpers to capitalize on multiple opportunities, even in choppy or range-bound markets. The ability to enter and exit trades quickly enables scalpers to adapt to changing market conditions and exploit short-term price fluctuations.

Disadvantages:

- High Transaction Costs: The frequent execution of trades in scalping can result in increased transaction costs. These costs include spreads, commissions, and slippage, which can eat into profits, particularly when trading with high volume or in markets with wide spreads. Scalpers need to carefully consider transaction costs and ensure that they do not outweigh potential gains.

- Intense Monitoring: Successful scalping requires constant monitoring of price movements and market conditions. Scalpers must remain vigilant throughout the trading session, ready to enter and exit trades swiftly as opportunities arise. This intense level of monitoring demands significant time and attention from traders, making it unsuitable for those unable to commit to active trading.

- Emotional Discipline: The rapid pace of scalping can exacerbate emotional trading tendencies. Quick decision-making and execution can lead to impulsive actions driven by fear or greed, potentially resulting in losses. Maintaining emotional discipline is crucial for scalpers to adhere to their trading plans, manage risk effectively, and avoid making irrational decisions under pressure.

In conclusion, while Forex scalping offers the potential for quick profits and reduced exposure to market risks, it also presents challenges such as high transaction costs, intense monitoring requirements, and the need for emotional discipline. Scalpers must weigh these advantages and disadvantages carefully, ensuring that they have the necessary skills, resources, and mindset to succeed in this fast-paced trading environment.

Developing a profitable Forex scalping strategy

Forex scalping, like any trading strategy, comes with its own set of advantages and disadvantages:

Advantages:

- Quick Profits: One of the primary attractions of Forex scalping is its ability to generate rapid profits. By capitalizing on small price movements, scalpers aim to accumulate gains over multiple trades within a short timeframe. This rapid turnover can lead to a steady stream of profits for skilled scalpers.

- Reduced Exposure to Market Risks: Scalping trades are typically held for very short durations, often just a few seconds to minutes. As a result, scalpers are less exposed to overnight risks, such as unexpected market gaps or geopolitical events. By closing positions before the end of the trading day, scalpers can mitigate the impact of external factors on their trades.

- High Trading Frequency: Scalpers thrive on high trading frequency, executing numerous trades throughout a trading session. This frequent activity allows scalpers to capitalize on multiple opportunities, even in choppy or range-bound markets. The ability to enter and exit trades quickly enables scalpers to adapt to changing market conditions and exploit short-term price fluctuations.

Disadvantages:

- High Transaction Costs: The frequent execution of trades in scalping can result in increased transaction costs. These costs include spreads, commissions, and slippage, which can eat into profits, particularly when trading with high volume or in markets with wide spreads. Scalpers need to carefully consider transaction costs and ensure that they do not outweigh potential gains.

- Intense Monitoring: Successful scalping requires constant monitoring of price movements and market conditions. Scalpers must remain vigilant throughout the trading session, ready to enter and exit trades swiftly as opportunities arise. This intense level of monitoring demands significant time and attention from traders, making it unsuitable for those unable to commit to active trading.

- Emotional Discipline: The rapid pace of scalping can exacerbate emotional trading tendencies. Quick decision-making and execution can lead to impulsive actions driven by fear or greed, potentially resulting in losses. Maintaining emotional discipline is crucial for scalpers to adhere to their trading plans, manage risk effectively, and avoid making irrational decisions under pressure.

In conclusion, while Forex scalping offers the potential for quick profits and reduced exposure to market risks, it also presents challenges such as high transaction costs, intense monitoring requirements, and the need for emotional discipline. Scalpers must weigh these advantages and disadvantages carefully, ensuring that they have the necessary skills, resources, and mindset to succeed in this fast-paced trading environment.

Essential tools for successful Forex scalping

Successful Forex scalping hinges on the effective utilization of essential tools and resources tailored to the fast-paced nature of short-term trading:

- Reliable Trading Platform: Selecting a robust and reliable trading platform is paramount for successful scalping. Look for platforms that offer fast execution speeds, minimal latency, and stable connectivity to ensure timely order execution. Additionally, advanced charting tools and customizable interface features are beneficial for analyzing price movements and implementing scalping strategies efficiently. Traders should choose platforms offered by reputable brokers with a track record of reliability and security to safeguard their trading activities.

- Real-time Data Feeds: Access to real-time market data is indispensable for scalpers to identify trading opportunities and make informed decisions swiftly. Reliable data feeds provide up-to-the-moment pricing information, order book depth, and market sentiment indicators, enabling scalpers to react promptly to changing market conditions. It’s essential to subscribe to data feeds from reputable sources or leverage trading platforms that offer comprehensive real-time data coverage across various financial instruments and markets.

- Scalping-specific Indicators: Utilizing technical indicators specifically tailored to short-term trading is crucial for effective scalping strategies. Scalpers rely on indicators that can quickly identify entry and exit points, gauge market momentum, and highlight potential reversals within short timeframes. Commonly used scalping indicators include:

- Moving Averages: Short-term moving averages (e.g., 5-period or 10-period) help identify immediate price trends and potential support/resistance levels.

- Stochastic Oscillator: This momentum indicator identifies overbought and oversold conditions, signaling potential reversal points in price.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements, offering insights into market momentum and potential trend reversals, particularly within short timeframes.

- Bollinger Bands: These volatility bands help identify price breakouts and potential trend reversals, assisting scalpers in determining optimal entry and exit points.

By leveraging scalping-specific indicators alongside a reliable trading platform and real-time data feeds, scalpers can enhance their ability to identify short-term trading opportunities, execute trades swiftly, and capitalize on rapid price movements in the Forex market. Additionally, continuous monitoring and adaptation of tools and strategies based on evolving market conditions are essential for maintaining a competitive edge in Forex scalping.

Risk management techniques for Forex scalping

Effective risk management is critical in Forex scalping to mitigate potential losses and safeguard capital amid the rapid pace of short-term trading. Implementing key risk management techniques can help scalpers navigate market volatility and maintain profitability. Here are essential risk management strategies tailored to Forex scalping:

- Setting Stop-loss Orders: Establishing predetermined exit points through stop-loss orders is fundamental to limiting losses in scalping trades. Scalpers should define stop-loss levels based on technical analysis, support/resistance levels, or volatility metrics to ensure that potential losses are contained within acceptable thresholds. By adhering to stop-loss orders, scalpers can effectively manage downside risk and protect their trading capital from excessive drawdowns.

- Using Proper Position Sizing: Determining appropriate position sizes is crucial for managing risk in Forex scalping. Scalpers should calculate position sizes based on their risk tolerance, account equity, and the distance to their stop-loss levels. By allocating a percentage of their trading capital to each trade and adjusting position sizes accordingly, scalpers can avoid overexposure to individual trades and minimize the impact of losses on their overall portfolio. Utilizing proper position sizing helps maintain consistency in risk management and preserves capital during periods of market volatility.

- Diversifying Trading Instruments: Spreading risk across multiple currency pairs is a prudent risk management strategy for Forex scalpers. Diversifying trading instruments allows scalpers to reduce their reliance on a single asset or market, thereby mitigating the impact of adverse price movements or systemic risks specific to certain currencies. Scalpers can diversify their trading portfolio by selecting currency pairs with low correlation or by incorporating other financial instruments, such as commodities or indices, into their trading strategy. By diversifying trading instruments, scalpers can enhance risk-adjusted returns and minimize the potential for significant losses from concentrated positions.

By incorporating these risk management techniques into their trading approach, Forex scalpers can effectively control downside risk, preserve capital, and maintain long-term profitability in the dynamic and fast-paced environment of short-term trading. Consistent application of sound risk management principles is essential for sustaining success and navigating the inherent challenges of Forex scalping.

Best currency pairs for Forex scalping

In Forex scalping, selecting the right currency pairs is crucial for maximizing trading opportunities and minimizing execution risks. While various currency pairs are available for scalping, certain pairs are particularly well-suited due to their liquidity, volatility, and tight spreads. Here are some of the best currency pairs for Forex scalping:

- EUR/USD (Euro/US Dollar):

- Widely regarded as the most traded currency pair in the Forex market, EUR/USD offers excellent liquidity and tight spreads, making it highly conducive to scalping strategies.

- The Euro and US Dollar are from two of the world’s largest economies, ensuring a high volume of trading activity and market depth, ideal for executing rapid trades with minimal slippage.

- Scalpers often capitalize on the frequent price fluctuations and predictable price patterns exhibited by EUR/USD, allowing for consistent profit opportunities throughout the trading day.

- USD/JPY (US Dollar/Japanese Yen):

- USD/JPY is renowned for its liquidity and price volatility, making it a favored choice among scalpers seeking fast-paced trading opportunities.

- The Japanese Yen is considered a safe-haven currency, prone to rapid movements in response to geopolitical events, economic data releases, and shifts in market sentiment.

- The relatively tight spreads and high liquidity of USD/JPY facilitate quick trade execution, enabling scalpers to capitalize on short-term price movements and intra-day fluctuations for profit.

- GBP/USD (British Pound/US Dollar):

- GBP/USD is known for its volatility and ample trading opportunities, making it a popular choice for Forex scalping.

- The British Pound and US Dollar exhibit significant price movements in response to economic news releases, central bank announcements, and geopolitical developments, providing scalpers with numerous trading setups throughout the trading session.

- Despite slightly wider spreads compared to EUR/USD, GBP/USD’s volatility often translates into larger profit potentials for scalpers who can effectively capitalize on price fluctuations.

When selecting currency pairs for scalping, traders should prioritize liquidity, volatility, and tight spreads to optimize trade execution and minimize trading costs. Additionally, thorough market analysis and understanding of each currency pair’s unique characteristics are essential for identifying optimal entry and exit points and executing successful scalping strategies. By focusing on high-liquidity pairs with favorable trading conditions like EUR/USD, USD/JPY, and GBP/USD, scalpers can enhance their trading efficiency and maximize their chances of achieving consistent profitability in the Forex market.

Psychological aspects of Forex scalping

Successful Forex scalping requires a disciplined mindset and strong psychological resilience. Key psychological aspects include:

- Patience and Discipline: Maintain discipline in adhering to trading rules and avoiding impulsive decisions driven by emotions.

- Stress Management: Manage stress effectively to prevent emotional trading and maintain focus during rapid market movements.

- Confidence in Strategy: Develop confidence in the chosen scalping strategy through backtesting and forward testing to enhance trading conviction.

Common mistakes to avoid in Forex scalping

To avoid common pitfalls in Forex scalping, traders should steer clear of the following mistakes:

- Overtrading: Resist the urge to overtrade by sticking to predetermined trading plans and avoiding impulsive decisions.

- Neglecting Risk Management: Prioritize risk management to safeguard capital and prevent significant losses.

- Chasing Profits: Avoid chasing price movements and focus on disciplined execution of trading strategies based on predefined criteria.

Conclusion: Becoming a successful Forex scalper

Mastering Forex scalping requires a combination of technical expertise, risk management skills, and psychological resilience. By developing a well-defined scalping strategy, utilizing appropriate tools and indicators, and maintaining discipline and emotional control, traders can increase their chances of success in the dynamic world of Forex scalping. While challenges and risks abound, diligent practice, continuous learning, and adherence to proven principles can pave the way to becoming a proficient and profitable Forex scalper.

In conclusion, Forex scalping offers lucrative opportunities for traders seeking to capitalize on short-term price movements in the currency markets. By understanding the intricacies of scalping strategies, employing effective risk management techniques, and cultivating the right psychological mindset, traders can navigate the challenges of scalping and enhance their chances of success in this fast-paced trading environment.

Read our latest article on Trading Course

FAQs

- What is Forex scalping?

- Forex scalping is a trading strategy where traders aim to profit from small price movements by executing numerous trades within a short timeframe, typically holding positions for seconds to minutes.

- What are some common indicators used in Forex scalping?

- Common indicators for Forex scalping include moving averages, stochastic oscillator, relative strength index (RSI), and Bollinger Bands.

- How do moving averages contribute to Forex scalping?

- Moving averages help identify short-term trends, potential entry and exit points, and act as dynamic support and resistance levels for scalping traders.

- What are the advantages of Forex scalping?

- Advantages of Forex scalping include the potential for quick profits, reduced exposure to overnight risks, and the ability to capitalize on high trading frequency.

- What are the disadvantages of Forex scalping?

- Disadvantages of Forex scalping include high transaction costs due to frequent trading, the need for intense monitoring of price movements, and the challenge of maintaining emotional discipline during rapid decision-making.

- What are some essential tools for successful Forex scalping?

- Essential tools for Forex scalping include a reliable trading platform with fast execution speeds, real-time data feeds for market analysis, and scalping-specific indicators for identifying trading opportunities.

- How can traders effectively manage risk in Forex scalping?

- Traders can manage risk in Forex scalping by setting stop-loss orders to limit losses, using proper position sizing to avoid overexposure, and diversifying trading instruments to spread risk across multiple currency pairs.

- Which currency pairs are best suited for Forex scalping?

- Popular currency pairs for Forex scalping include EUR/USD, USD/JPY, and GBP/USD due to their liquidity, volatility, and tight spreads.

- Why is emotional discipline important in Forex scalping?

- Emotional discipline is crucial in Forex scalping to prevent impulsive decisions, manage risk effectively, and adhere to trading plans amidst the rapid pace of short-term trading.

- How can traders become successful in Forex scalping?

- Traders can become successful in Forex scalping by developing a well-defined scalping strategy, utilizing effective risk management techniques, and maintaining emotional discipline and psychological resilience throughout their trading journey.

Click here to read more on Forex Scalping