Introduction

In the dynamic world of forex trading, mastering different strategies is essential for success. One such strategy that has gained popularity among traders is breakout and retracement trading. This strategy involves identifying key price levels where a breakout or retracement is likely to occur and capitalizing on these market movements. In this comprehensive guide, we will explore the intricacies of breakout and retracement trading, including strategies for identifying opportunities, using technical indicators, developing trading plans, and analyzing case studies to illustrate successful trades.

What is Breakout and Retracement Strategy?

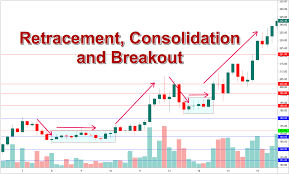

Breakout and retracement strategy is a sophisticated trading methodology that leverages the dynamics of market movements to capture profit opportunities. This approach is grounded in the recognition and exploitation of two distinct yet interconnected patterns: breakouts and retracements.

A breakout is a pivotal event in the market characterized by the price of an asset surging beyond a significant level of support or resistance. When the price breaches these critical thresholds, it signals a potential shift in market sentiment and the initiation of a new trend or the acceleration of the current trend. Breakouts can manifest in various forms, including upside breakouts where prices ascend above resistance levels or downside breakouts where prices plummet below support levels. These breakout points serve as critical junctures where traders seek to capitalize on the momentum generated by the surge in price action.

Conversely, a retracement represents a temporary pullback or reversal in the prevailing trend before the price resumes its original trajectory. During a retracement, prices retreat from recent highs or lows, often retracing a portion of the preceding price movement. Retracements can be triggered by profit-taking, market corrections, or the re-evaluation of market fundamentals. While retracements may appear counterintuitive to the prevailing trend, they offer strategic entry opportunities for traders to position themselves favorably in anticipation of the trend’s continuation.

By incorporating both breakout and retracement patterns into their trading strategy, traders aim to exploit the cyclical nature of market movements and profit from the ensuing price volatility. Breakout traders endeavor to capitalize on the initial surge of momentum following a breakout, seeking to ride the trend for maximum profit potential. On the other hand, retracement traders seek to enter the market at advantageous price levels during temporary pullbacks, enabling them to establish positions with favorable risk-reward ratios.

Moreover, breakout and retracement strategies are not mutually exclusive; they often complement each other to form a comprehensive trading approach. Breakout traders may utilize retracement patterns to fine-tune their entry points, while retracement traders may employ breakout signals to confirm the validity of the prevailing trend. By combining these complementary strategies, traders can enhance the robustness and effectiveness of their trading methodology, thereby increasing their chances of success in the competitive realm of financial markets.

In essence, breakout and retracement strategy represents a nuanced approach to trading that harnesses the ebb and flow of market dynamics. By adeptly navigating these patterns and strategically timing their entries and exits, traders can capitalize on the ever-changing landscape of price action and achieve consistent profitability in the dynamic world of trading.

Identifying Breakout Opportunities

Identifying breakout opportunities is a critical aspect of successful trading, requiring traders to effectively recognize key levels of support and resistance where significant price movements are likely to occur. This process involves employing various technical analysis tools and techniques to identify potential breakout points and validate trading opportunities. Here’s an in-depth exploration of how traders can identify breakout opportunities using different methods and market conditions:

- Key Levels of Support and Resistance: The foundation of identifying breakout opportunities lies in identifying key levels of support and resistance on price charts. Support levels represent areas where buying pressure outweighs selling pressure, preventing prices from falling further. Resistance levels, conversely, denote areas where selling pressure exceeds buying pressure, hindering price advances. Traders can identify these levels by analyzing historical price data and identifying areas where prices have repeatedly reversed direction.

- Technical Analysis Tools: Traders can utilize a variety of technical analysis tools to identify potential breakout points. Trendlines, drawn by connecting successive highs or lows on a price chart, can help traders visualize the direction of the prevailing trend and identify potential breakout levels. Additionally, chart patterns such as triangles, rectangles, and wedges often precede breakout movements, providing traders with clear visual cues for potential trading opportunities.

- Pivot Points: Pivot points are calculated based on the previous day’s high, low, and close prices and serve as significant levels of support and resistance in the market. Traders use pivot points to identify potential breakout opportunities, with price movements above or below pivot levels signaling potential breakouts. Pivot points can be combined with other technical indicators to enhance their effectiveness in identifying breakout points.

- Market Conditions: Breakouts can occur in various market conditions, including trending markets, range-bound markets, and consolidating markets. In trending markets, breakouts often occur in the direction of the prevailing trend, signaling the continuation of the trend. In range-bound markets, breakouts occur when prices move beyond the established trading range, signaling a potential shift in market sentiment. In consolidating markets, breakouts can occur following periods of low volatility, indicating a potential surge in market activity.

- Confirmation Signals: Traders often look for confirmation signals to validate breakout opportunities before entering trades. Increased volume accompanying a breakout can serve as confirmation of the validity of the breakout movement, indicating strong market participation. Similarly, momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can be used to confirm breakout signals by assessing the strength of price movements.

By effectively identifying breakout opportunities using these methods and techniques, traders can increase their chances of success in capitalizing on significant price movements in the market. However, it’s essential for traders to exercise caution and employ proper risk management strategies to mitigate potential losses associated with trading breakouts.

Understanding Retracement Patterns

Understanding retracement patterns is essential for traders looking to capitalize on market movements and identify strategic entry points. Retracement patterns occur when the price temporarily moves in the opposite direction of the prevailing trend before resuming its original trajectory. These patterns often provide traders with lucrative opportunities to enter trades at favorable prices while minimizing risk. Here’s an in-depth exploration of common retracement patterns and how traders can leverage them effectively:

- Fibonacci Retracements: Fibonacci retracements are among the most widely used retracement patterns in technical analysis. Based on the Fibonacci sequence, these retracement levels—namely 23.6%, 38.2%, 50%, 61.8%, and 78.6%—serve as key support or resistance levels where price often retraces before continuing its trend. Traders use Fibonacci retracements to identify potential entry points in the direction of the prevailing trend, with the expectation that prices will bounce off these levels and continue their original trajectory.

- Pullbacks to Moving Averages: Moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), are widely used indicators that help smooth out price fluctuations and identify the direction of the prevailing trend. During strong trending markets, prices often pull back to test the moving average before resuming their upward or downward movement. Traders can use these pullbacks to moving averages as opportunities to enter trades in alignment with the trend, with the moving average serving as a dynamic level of support or resistance.

- Pullbacks to Trendlines: Trendlines are drawn by connecting consecutive highs or lows on a price chart and serve as visual representations of the prevailing trend. During retracements, prices often pull back to test the trendline before continuing in the direction of the trend. Traders can use these pullbacks to trendlines as potential entry points, with the trendline acting as a dynamic level of support or resistance. Breaks of trendlines can also signal potential trend reversals, providing traders with opportunities to enter counter-trend trades.

Traders can leverage retracement patterns to identify strategic entry points in alignment with the prevailing trend, thereby maximizing profit potential while minimizing risk. By combining retracement patterns with other technical indicators and confirmation signals, traders can increase the probability of successful trades and enhance their overall trading performance. However, it’s essential for traders to exercise proper risk management and adhere to their trading plans to mitigate potential losses associated with trading retracements.

Using Technical Indicators to Confirm Breakouts and Retracements

Technical indicators play a crucial role in confirming breakout and retracement signals. Common indicators used by traders include moving averages, oscillators (e.g., RSI, Stochastic), and volume indicators. Moving averages can help identify the direction of the trend and potential support or resistance levels. Oscillators can indicate overbought or oversold conditions, signaling potential reversal points. Volume indicators can confirm the strength of breakouts or retracements, providing additional validation for trade entries.

How to Find High Probability Breakout Trading

Finding high probability breakout trading opportunities requires a combination of technical analysis and market observation. Traders should focus on trading setups with clear and significant levels of support or resistance, preferably accompanied by strong volume and momentum. Additionally, traders can use price action analysis to identify breakout patterns such as continuation patterns (e.g., flags, pennants) or volatility expansion patterns (e.g., volatility breakouts). By incorporating multiple confluence factors, traders can increase the probability of successful breakout trades.

Developing a Breakout and Retracement Trading Plan

Developing a breakout and retracement trading plan is essential for consistency and discipline in trading. A trading plan should outline clear entry and exit criteria, risk management rules, and trade management strategies. Traders should define their risk-reward ratios, position sizing strategies, and maximum allowable drawdowns to protect their capital. Additionally, traders should backtest their trading plan on historical data and continuously evaluate its performance to identify areas for improvement.

Case Studies and Examples of Successful Breakout and Retracement Trades

Examining case studies and examples of successful breakout and retracement trades offers invaluable insights into the practical application of these trading strategies. By delving into real-world scenarios, traders can gain a deeper understanding of the dynamics at play, refine their analytical skills, and hone their decision-making abilities. Let’s explore some illustrative case studies to elucidate the effectiveness of breakout and retracement trading strategies:

- Breakout Trade Example: Scenario: In a trending market, the price of a currency pair has been consolidating within a narrow range for an extended period, indicating potential breakout opportunities. Analysis: Traders identify a clear resistance level that has been tested multiple times without a breakthrough. As the price approaches this resistance level again, traders observe a surge in trading volume, signaling increased market participation. Trade Execution: Upon the breakout above the resistance level, traders enter a long position, anticipating further upward momentum. They set a stop-loss order below the breakout level to manage risk and maximize profit potential. Outcome: The price continues to rally strongly following the breakout, validating the trade decision. Traders may choose to trail their stop-loss or take partial profits as the trend unfolds, thereby securing gains while allowing room for further upside potential.

- Retracement Trade Example: Scenario: In a strong uptrend, the price of a currency pair experiences a temporary pullback to a key Fibonacci retracement level. Analysis: Traders identify the Fibonacci retracement levels, with the 50% retracement level coinciding with a previously established support level. Additionally, the pullback aligns with the rising trendline, further reinforcing the potential support zone. Trade Execution: Recognizing the confluence of support factors, traders enter a long position near the 50% Fibonacci retracement level, placing a stop-loss order below the recent swing low to limit downside risk. Outcome: The price bounces off the support zone, confirming the validity of the retracement trade. As the uptrend resumes, traders may consider scaling out of their position or trailing their stop-loss to secure profits and protect against potential reversals.

Through these case studies, traders gain insights into the importance of patience, discipline, and risk management in executing successful breakout and retracement trades. They learn to identify key entry and exit points, interpret price action dynamics, and adapt their strategies to prevailing market conditions. Moreover, these examples underscore the significance of continuous learning and practical application in achieving consistent profitability in forex trading.

By studying real-world examples and dissecting the rationale behind trade decisions, traders can refine their skills, build confidence in their trading approach, and navigate the intricacies of the market with greater proficiency. Ultimately, case studies serve as invaluable learning tools that empower traders to make informed decisions, mitigate risks, and capitalize on opportunities in the dynamic world of forex trading.

Merit and Demerits of Breakout Trading

Breakout trading is a popular strategy among traders due to its potential for capturing significant price movements and providing clear entry and exit signals. However, like any trading approach, breakout trading has its merits and demerits. Let’s delve deeper into both aspects:

Merits of Breakout Trading:

- Capturing Large Price Movements: Breakout trading allows traders to capitalize on significant price movements that occur when an asset breaks out of a consolidation phase or a well-defined trading range. By entering trades at the onset of a breakout, traders can ride the momentum and potentially profit from substantial price swings.

- Quick Profit Opportunities: Breakout trades often result in rapid price movements, providing traders with the opportunity to generate quick profits. Since breakouts typically occur after periods of consolidation or compression, traders can seize opportunities for swift gains by entering trades at the onset of a breakout and capturing the initial momentum.

- Clear Entry and Exit Signals: Breakouts are characterized by clear and discernible entry and exit signals, making it easier for traders to execute their trades with precision. Breakouts occur when the price breaches a significant level of support or resistance, providing traders with a clear signal to enter a trade. Similarly, exit signals can be determined based on predefined criteria, such as trailing stop-loss orders or profit targets.

Demerits of Breakout Trading:

- False Breakouts: One of the inherent risks of breakout trading is the occurrence of false breakouts, where the price briefly breaches a support or resistance level before reversing direction. False breakouts can result in losses for traders who enter trades prematurely, expecting a continuation of the breakout momentum. Traders must exercise caution and wait for confirmation before entering breakout trades to avoid falling victim to false signals.

- Whipsaws: Breakout trading can be susceptible to whipsaws, which are sudden and sharp reversals in price direction following a breakout. Whipsaws can occur due to market volatility, unexpected news events, or shifts in market sentiment, causing traders to incur losses if they fail to react swiftly and adjust their positions accordingly. Traders must remain vigilant and implement risk management measures to mitigate the impact of whipsaw movements.

- Increased Volatility During Breakout Periods: Breakout periods are often characterized by heightened volatility as market participants react to the emergence of new price levels and potential trend reversals. Increased volatility can lead to erratic price movements, making it challenging for traders to accurately gauge market direction and manage their positions effectively. Traders should exercise caution and be prepared for heightened volatility during breakout periods by adjusting their position sizes and risk exposure accordingly.

In summary, while breakout trading offers the potential for capturing large price movements and quick profits, traders must also be mindful of the inherent risks, including false breakouts, whipsaws, and increased volatility. By employing proper risk management techniques, exercising patience, and waiting for confirmation signals, traders can mitigate these risks and enhance their chances of success in breakout trading.

Conclusion

In conclusion, mastering breakout and retracement trading strategies requires a combination of technical analysis skills, market observation, and disciplined execution. By identifying breakout and retracement opportunities, using technical indicators to confirm signals, and developing a robust trading plan, traders can capitalize on market movements and achieve consistent profitability.

While breakout trading offers lucrative opportunities, traders must also be mindful of the inherent risks and adopt a prudent approach to risk management. With dedication, practice, and continuous learning, traders can unlock the potential of breakout and retracement trading and enhance their trading performance in the dynamic forex market.

Read our latest article on Forex Trading Books

FAQs

- FAQ: What is breakout trading, and why is it popular among traders?

Answer: Breakout trading is a strategy that involves entering trades when the price breaks above or below a significant level of support or resistance. It’s popular because it offers the potential for capturing large price movements and provides clear entry and exit signals. - FAQ: What are some common examples of breakout patterns?

Answer: Common breakout patterns include ascending triangles, descending triangles, rectangles, and flags. These patterns occur when the price consolidates within a defined range before breaking out in the direction of the prevailing trend. - FAQ: How can traders identify breakout opportunities?

Answer: Traders can identify breakout opportunities by recognizing key levels of support and resistance using technical analysis tools such as trendlines, chart patterns, and pivot points. Breakouts are often accompanied by increased volume and momentum, providing confirmation signals for traders. - FAQ: What are the merits of breakout trading?

Answer: The merits of breakout trading include the potential for capturing large price movements, quick profit opportunities, and clear entry and exit signals. Breakout trading allows traders to capitalize on momentum and exploit significant shifts in market sentiment. - FAQ: What are some common risks associated with breakout trading?

Answer: Common risks associated with breakout trading include false breakouts, whipsaws, and increased volatility during breakout periods. Traders must be aware of these risks and employ proper risk management techniques to mitigate them effectively. - FAQ: How can traders avoid falling victim to false breakouts?

Answer: Traders can avoid false breakouts by waiting for confirmation signals before entering trades. Confirmation signals may include increased volume, a strong candlestick close beyond the breakout level, or validation from other technical indicators. - FAQ: What role does risk management play in breakout trading?

Answer: Risk management is crucial in breakout trading to mitigate potential losses during adverse market conditions. Traders should set stop-loss orders, define their risk-reward ratios, and limit their position sizes to ensure they can withstand potential drawdowns. - FAQ: Can breakout trading be applied to different market conditions?

Answer: Yes, breakout trading can be applied to various market conditions, including trending markets, range-bound markets, and consolidating markets. Traders must adapt their strategies based on the prevailing market conditions and adjust their approach accordingly. - FAQ: How can traders refine their breakout trading skills?

Answer: Traders can refine their breakout trading skills through practice, experience, and continuous learning. Analyzing historical data, studying past trades, and staying updated on market developments can help traders enhance their understanding of breakout patterns and improve their decision-making abilities. - FAQ: Are there any specific techniques for managing risk in breakout trading?

Answer: Yes, traders can employ specific risk management techniques in breakout trading, such as trailing stop-loss orders, scaling in and out of positions, and diversifying their trading portfolios. By implementing these techniques, traders can effectively manage risk and optimize their trading performance.

Click here to read more on Breakout and Retracement