Introduction to Forex Trading Books

In the dynamic world of forex trading, where fortunes are made and lost in the blink of an eye, the significance of education cannot be overstated. Unlike traditional financial markets, forex trading offers unparalleled opportunities for individuals to participate in global currency exchange. However, navigating this complex landscape requires more than just luck or intuition; it demands a deep understanding of market dynamics, strategies, and risk management principles.

In this article, we delve into the pivotal role of education in forex trading, focusing particularly on the benefits of reading trading books and how to select the right ones to propel your journey towards success.

The Importance of Education in Forex Trading

Forex trading is not a game of chance; it is a skill that can be mastered through continuous learning and practice. Education forms the cornerstone of success in this field for several reasons:

Understanding Market Fundamentals: Forex markets are influenced by a myriad of factors, including economic indicators, geopolitical events, and central bank policies. A solid educational foundation equips traders with the knowledge to interpret these factors and anticipate market movements accurately. Forex markets are influenced by a complex interplay of economic, political, and social factors. An educated trader not only recognizes these influences but also understands their implications on currency values.

For instance, knowledge of key economic indicators such as GDP growth, inflation rates, and employment figures allows traders to anticipate how central banks might adjust monetary policy, thereby affecting currency valuations. Similarly, awareness of geopolitical tensions or major political events can influence investor sentiment and lead to currency fluctuations.

Developing Trading Strategies: Successful traders rely on well-defined strategies tailored to their risk tolerance, trading style, and market conditions. Education provides traders with access to a diverse range of strategies, allowing them to identify and adopt approaches that align with their objectives.Education empowers traders to develop and fine-tune their trading strategies based on a thorough understanding of market dynamics.

For example, a trader may adopt a trend-following strategy in a trending market environment, leveraging technical indicators such as moving averages to identify entry and exit points. Conversely, in a range-bound market, a trader may employ a mean-reversion strategy, buying at support levels and selling at resistance levels. By diversifying their toolkit with various strategies, traders can adapt to different market conditions and enhance their probability of success.

Risk Management: Effective risk management is essential for preserving capital and sustaining long-term profitability. Through education, traders learn how to manage risks proactively by implementing stop-loss orders, diversifying their portfolios, and sizing their positions appropriately. Effective risk management is the bedrock of sustainable trading performance.

Through education, traders learn not only how to identify potential risks but also how to mitigate them. For instance, setting stop-loss orders helps limit losses in case a trade moves against expectations, while diversifying across multiple currency pairs reduces exposure to any single market event. Moreover, understanding the concept of position sizing enables traders to allocate capital prudently, ensuring that no single trade significantly impacts their overall portfolio.

Technical Analysis Skills: Technical analysis plays a crucial role in forex trading, enabling traders to identify trends, patterns, and potential entry/exit points. Education helps traders develop proficiency in technical analysis tools and charting techniques, empowering them to make informed trading decisions. Technical analysis serves as a valuable tool for identifying trading opportunities and managing risk.

By studying price charts and applying technical indicators, traders gain insights into market trends, support and resistance levels, and potential reversal patterns. For instance, the recognition of a “double top” pattern on a currency chart may signal a potential trend reversal, prompting a trader to adjust their positions accordingly. Moreover, proficiency in technical analysis enables traders to conduct thorough market analysis efficiently, allowing for more informed decision-making.

Emotional Discipline: Emotions such as fear, greed, and impatience can cloud judgment and lead to irrational decision-making in forex trading. Education fosters emotional discipline by teaching traders to adhere to trading plans, exercise patience, and maintain a rational mindset even in the face of adversity.

Emotions can often cloud judgment and lead to impulsive decisions in forex trading. Education plays a crucial role in fostering emotional discipline by providing traders with the knowledge and mindset to manage their emotions effectively. For example, traders learn to recognize common emotional biases such as fear of missing out (FOMO) or revenge trading and develop strategies to counteract them.

Additionally, through simulated trading exercises or real-life trading experiences, traders can practice maintaining a rational mindset and adhering to predefined trading plans, thereby minimizing the impact of emotions on their decision-making process.

In conclusion, education forms the bedrock of success in forex trading by equipping traders with the knowledge, skills, and discipline needed to navigate the complexities of the market. By understanding market fundamentals, developing robust trading strategies, implementing effective risk management techniques, honing technical analysis skills, and cultivating emotional discipline, traders can enhance their probability of success and achieve their trading objectives in the dynamic world of forex trading.

The Benefits of Reading Forex Trading Books

Among the various educational resources available to forex traders, books remain a timeless and invaluable source of knowledge. Here are some benefits of incorporating forex trading books into your learning journey:

Comprehensive Coverage: Forex trading books often offer comprehensive coverage of various topics, ranging from fundamental analysis and technical indicators to advanced trading strategies and risk management principles. They serve as comprehensive guides that cater to traders of all skill levels. Forex trading books provide a holistic overview of the various aspects of currency trading, catering to traders of all levels, from beginners to advanced practitioners.

These books delve into fundamental concepts such as currency pairs, exchange rates, and market participants, laying a solid foundation for understanding how the forex market operates. Furthermore, they explore technical analysis tools and methodologies, helping traders identify trends, patterns, and key levels on price charts. Additionally, advanced topics such as algorithmic trading, quantitative analysis, and high-frequency trading are covered in some books, offering insights into cutting-edge strategies and technologies shaping the forex landscape.

Expert Insights: Many forex trading books are authored by seasoned traders, analysts, and industry experts who share their insights, experiences, and proven strategies. Learning from the successes and failures of these professionals can provide invaluable perspectives and lessons for aspiring traders. Authored by seasoned traders, analysts, and industry experts, forex trading books provide readers with access to a wealth of practical knowledge and real-world experiences.

These authors share their insights into market dynamics, trading strategies, risk management techniques, and psychological aspects of trading, offering valuable perspectives and lessons gleaned from years of trading in the forex markets. By learning from the successes and failures of these professionals, aspiring traders can accelerate their learning curve and avoid common pitfalls encountered by novice traders. Moreover, exposure to diverse viewpoints and trading styles expands traders’ horizons, enabling them to develop a well-rounded approach to forex trading.

Structured Learning: Forex trading books are typically structured in a logical and sequential manner, facilitating a systematic approach to learning. Readers can progress from foundational concepts to advanced topics at their own pace, reinforcing their understanding along the way. Forex trading books are typically organized in a logical and sequential manner, guiding readers through a step-by-step learning process.

Beginning with foundational concepts, such as currency basics and market mechanics, these books gradually progress to more advanced topics, including technical analysis, fundamental analysis, and trading psychology. This structured approach facilitates a systematic learning experience, allowing readers to build upon their knowledge incrementally and reinforce their understanding of key concepts.

Moreover, the clear presentation of information, coupled with illustrative examples and case studies, enhances comprehension and retention, making complex concepts more accessible to readers.

Accessibility: Unlike live seminars or courses that may require significant time and financial commitments, forex trading books offer a cost-effective and accessible means of education. They can be easily purchased or borrowed from libraries, allowing traders to learn conveniently from anywhere at any time. Unlike live seminars or courses that may require significant time and financial commitments, forex trading books offer a cost-effective and flexible means of education.

These books can be purchased online or from bookstores at relatively affordable prices, making them accessible to traders of all budgets. Furthermore, many libraries stock a wide selection of forex trading books, allowing traders to borrow them for free or at minimal cost. This accessibility ensures that traders can embark on their learning journey at their own pace and convenience, without being constrained by geographical or financial barriers.

Whether reading during downtime at home, on the commute to work, or while traveling, traders can leverage forex trading books to expand their knowledge and skills wherever they are.

Reference Materials: Forex trading books serve as valuable reference materials that traders can revisit whenever they encounter challenges or seek clarification on specific topics. Building a library of trusted trading books enables traders to continuously refine their skills and stay updated on market developments.

Forex trading books serve as valuable reference materials that traders can revisit whenever they encounter challenges or seek clarification on specific topics. Building a library of trusted trading books enables traders to create a repository of knowledge that they can tap into whenever needed. Whether revisiting fundamental concepts, refreshing technical analysis skills, or exploring new trading strategies, these reference materials provide a reliable source of information and guidance.

Moreover, as traders progress in their journey and encounter more advanced concepts or market scenarios, they can refer back to these books to deepen their understanding and adapt their approach accordingly. By continuously refining their skills and staying updated on market developments, traders can remain agile and responsive in the ever-evolving forex market landscape.

In summary, reading forex trading books offers a multitude of benefits for traders seeking to enhance their knowledge, skills, and performance in the forex market. From comprehensive coverage of essential concepts to insights from industry experts, structured learning experiences, accessibility, and reference materials, forex trading books serve as invaluable resources that empower traders to navigate the complexities of the market with confidence and competence. By incorporating forex trading books into their learning journey, traders can gain a competitive edge and achieve their trading goals more effectively.

How to Choose the Right Forex Trading Books

With a plethora of forex trading books available in the market, selecting the right ones can be daunting. Here are some factors to consider when choosing forex trading books:

- Author Credibility: Look for books authored by reputable traders, analysts, or educators with a proven track record in the forex industry. Research the author’s background, credentials, and reputation to ensure that the book offers reliable and trustworthy information.

- Content Relevance: Assess the relevance of the book’s content to your trading goals, experience level, and preferred trading style. Choose books that cover topics aligned with your specific interests and areas of improvement, whether it’s technical analysis, fundamental analysis, or trading psychology.

- Reader Reviews: Reading reviews and testimonials from other traders can provide valuable insights into the quality and effectiveness of a forex trading book. Look for books that have garnered positive feedback and recommendations from readers who have found them insightful and beneficial.

- Publication Date: Forex markets are constantly evolving, driven by economic trends, geopolitical events, and technological advancements. Prioritize books that are relatively recent and reflect the latest market dynamics, strategies, and best practices to ensure relevance and accuracy.

- Sample Chapters: Before making a purchase, consider previewing sample chapters or excerpts from the book to assess its writing style, clarity, and organization. This can help you gauge whether the book resonates with your learning preferences and comprehension level.

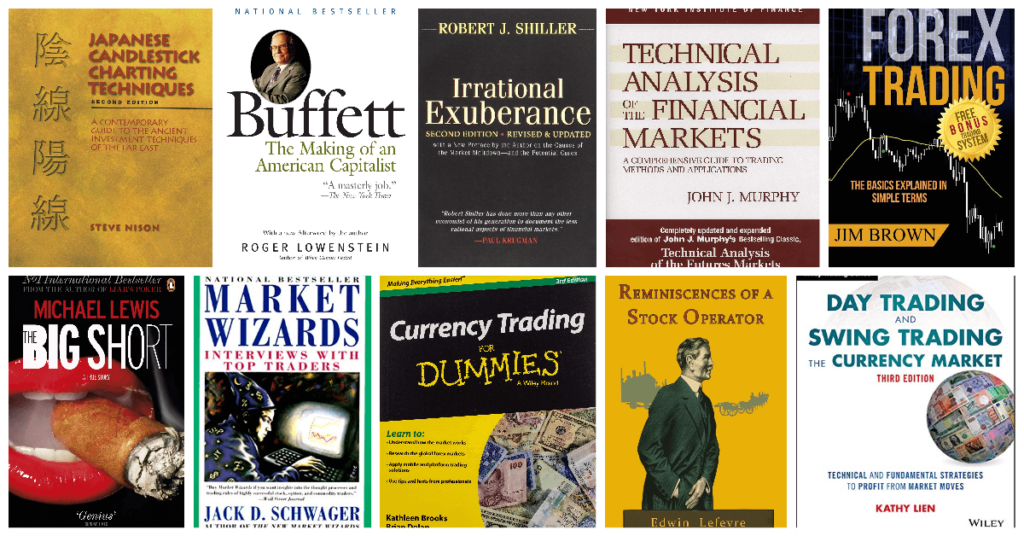

List of Top 5 Trading Books on Forex

- “Currency Trading for Dummies” by Kathleen Brooks and Brian Dolan: This beginner-friendly guide provides a comprehensive introduction to forex trading, covering fundamental concepts, trading strategies, and risk management techniques in an accessible manner.

- “Technical Analysis of the Financial Markets” by John J. Murphy: Regarded as a classic in technical analysis literature, this book offers in-depth insights into chart patterns, indicators, and trading strategies, making it indispensable for traders seeking to master technical analysis.

- “Trading in the Zone” by Mark Douglas: In this timeless masterpiece, Mark Douglas explores the psychological aspects of trading and shares invaluable wisdom on cultivating discipline, confidence, and consistency in one’s trading approach.

- “Reminiscences of a Stock Operator” by Edwin Lefèvre: While not specifically focused on forex trading, this autobiography of legendary trader Jesse Livermore offers profound lessons on market speculation, risk management, and the psychology of trading that are applicable to all traders.

- “Day Trading and Swing Trading the Currency Market” by Kathy Lien: As an experienced currency trader and educator, Kathy Lien provides practical strategies and techniques for both day trading and swing trading in the forex market, making this book a valuable resource for traders of all levels.

Conclusion

In conclusion, the fast-paced and competitive nature of the forex trading landscape underscores the pivotal role of education in achieving success. It serves as the cornerstone upon which traders build their expertise, enabling them to navigate the complexities of the market with confidence and proficiency. By investing in continuous learning and leveraging educational resources such as trading books, traders can equip themselves with the knowledge, skills, and mindset needed to thrive in this dynamic environment.

Whether you’re just starting out as a novice trader seeking to grasp the fundamentals or you’re an experienced trader looking to refine your strategies, the journey towards mastery invariably begins with education. Forex trading books, in particular, offer a wealth of insights, strategies, and practical wisdom from seasoned professionals, providing invaluable guidance at every stage of the learning process.

As you embark on this educational journey, it’s essential to approach learning with dedication, discipline, and a thirst for knowledge. Embrace the challenges and setbacks as opportunities for growth, and commit yourself to continuous improvement and refinement of your trading skills.

In the words of Benjamin Franklin, “An investment in knowledge pays the best interest.” Indeed, the time and effort invested in acquiring knowledge and honing your trading skills will yield dividends far beyond the realm of forex trading. Armed with a solid educational foundation, you’ll be better equipped to navigate the twists and turns of the market, seize opportunities, and mitigate risks effectively.

So, as you immerse yourself in the world of forex trading, remember the importance of education as your guiding light. Stay curious, stay hungry for knowledge, and never stop learning. With the right mindset and a commitment to lifelong learning, success in forex trading is within your reach. Happy trading!

Read our latest article on Swing Trading

FAQs

- FAQ: Why is education considered crucial in forex trading? Answer: Education is essential in forex trading because it equips traders with the knowledge, skills, and mindset needed to navigate the complex and dynamic nature of the forex market effectively.

- FAQ: How can understanding market fundamentals benefit forex traders? Answer: Understanding market fundamentals allows traders to interpret economic indicators, geopolitical events, and central bank policies, enabling them to anticipate market movements accurately and make informed trading decisions.

- FAQ: What role does risk management play in forex trading? Answer: Risk management is essential for preserving capital and sustaining long-term profitability in forex trading. Through effective risk management techniques such as implementing stop-loss orders and diversifying portfolios, traders can mitigate potential losses and protect their investments.

- FAQ: How can reading forex trading books help traders? Answer: Forex trading books offer comprehensive coverage of various topics, provide expert insights from seasoned traders, offer structured learning experiences, are accessible and affordable, and serve as valuable reference materials for traders seeking to enhance their knowledge and skills.

- FAQ: Why is emotional discipline important in forex trading? Answer: Emotional discipline is crucial in forex trading because emotions such as fear, greed, and impatience can cloud judgment and lead to irrational decision-making. Through education, traders learn to maintain a rational mindset, adhere to trading plans, and exercise patience, thereby improving their trading performance.

- FAQ: How can traders develop effective trading strategies? Answer: Traders can develop effective trading strategies by leveraging their understanding of market fundamentals, risk management principles, technical analysis tools, and trading psychology. By tailoring strategies to their risk tolerance, trading style, and market conditions, traders can increase their chances of success in forex trading.

- FAQ: What advantages do forex trading books offer over other educational resources? Answer: Forex trading books offer advantages such as comprehensive coverage of topics, insights from industry experts, structured learning experiences, accessibility and affordability, and serve as valuable reference materials for continuous learning and skill development.

- FAQ: How can traders choose the right forex trading books? Answer: Traders can choose the right forex trading books by considering factors such as author credibility, content relevance to their trading goals and experience level, reader reviews, publication date, and previewing sample chapters to ensure alignment with their learning preferences.

- FAQ: Why is continuous learning important for forex traders? Answer: Continuous learning is important for forex traders because the market is constantly evolving, driven by economic trends, geopolitical events, and technological advancements. By staying updated on market developments and refining their skills, traders can adapt to changing market conditions and improve their trading performance.

- FAQ: What is the significance of Benjamin Franklin’s quote, “An investment in knowledge pays the best interest,” in the context of forex trading? Answer: Benjamin Franklin’s quote underscores the importance of investing in education as a means of achieving long-term success in forex trading. By prioritizing learning and skill development, traders can unlock opportunities, mitigate risks, and ultimately maximize their returns in the forex market.

Click here to read more on Forex Trading Books