Introduction

Forex trading offers ample opportunities for profit, but it also comes with its own set of challenges. One such challenge that traders often encounter is slippage. Understanding what slippage is, its impact on forex trading, and how to manage it effectively is crucial for traders aiming to navigate the markets successfully. This comprehensive guide explores the phenomenon of forex slippage, its causes, tips for minimizing it, selecting the right broker, best practices, case studies, common mistakes, and key takeaways.

Understanding Forex Slippage

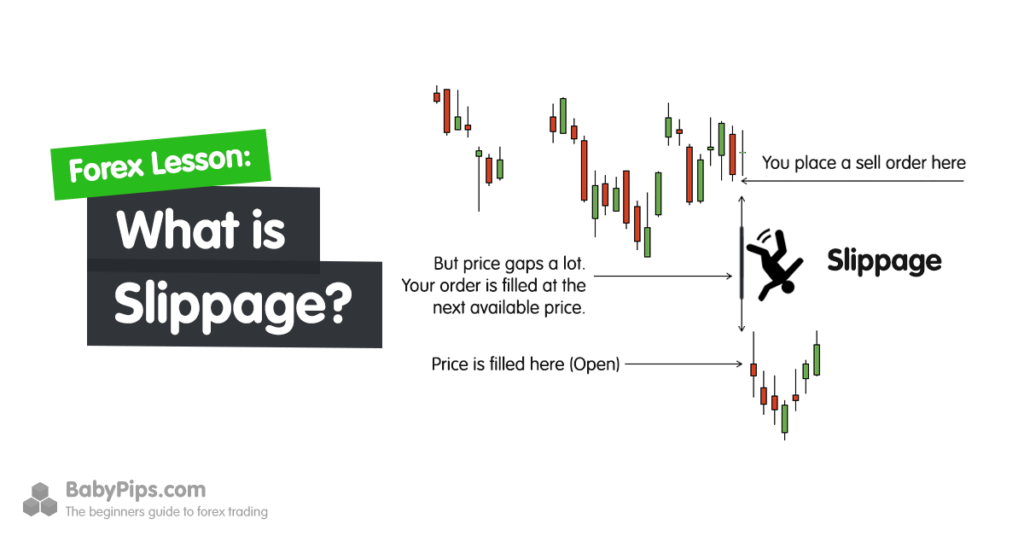

Forex slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. It occurs when there is a delay between placing an order and its execution, resulting in the trade being filled at a different price than anticipated. Slippage is a common occurrence in fast-moving or volatile markets, where prices can change rapidly between the time an order is placed and when it is executed.

The Impact of Slippage on Forex Trading

Slippage can have a significant impact on forex trading outcomes. For traders, slippage can lead to unexpected losses or reduced profits, as trades are executed at less favorable prices than desired. In extreme cases, slippage can result in substantial financial losses, particularly when trading large positions or during periods of heightened market volatility.

Causes of Slippage in Volatile Markets

Slippage in forex trading is often more pronounced in volatile markets, where rapid price movements and increased trading activity can lead to delays in order execution. Some common causes of slippage in volatile markets include:

- Market Liquidity: Low liquidity in the market can exacerbate slippage, as there may be fewer buyers or sellers willing to transact at a given price, leading to wider spreads and increased slippage.

- Order Size: Larger order sizes may struggle to find sufficient liquidity in the market, resulting in partial fills or slippage as the order is executed across multiple price levels.

- Market News and Events: Significant news announcements or events can trigger sudden spikes in volatility, causing prices to move rapidly and increasing the likelihood of slippage during order execution.

Tips for Minimizing Slippage in Forex Trading

While slippage cannot be entirely eliminated, traders can take steps to minimize its impact on their trading results. Some tips for minimizing slippage in forex trading include:

- Use Limit Orders: Limit orders allow traders to specify the maximum or minimum price at which they are willing to execute a trade. By using limit orders, traders can avoid slippage by ensuring that their trades are only executed at their desired price levels.

- Avoid Trading During High-Impact News Events: Trading during major news events or economic releases can increase the risk of slippage due to heightened market volatility. Traders may consider avoiding trading during these times or using protective measures such as wider stop-loss orders.

- Monitor Market Conditions: Keeping a close eye on market conditions, including liquidity levels, spreads, and volatility, can help traders anticipate potential slippage and adjust their trading strategies accordingly.

Choosing the Right Forex Broker to Minimize Slippage

Selecting the right forex broker is essential for minimizing slippage and ensuring optimal trading conditions. When choosing a forex broker, traders should consider factors such as:

- Execution Speed: A broker with fast and reliable order execution can help reduce the likelihood of slippage, especially in fast-moving markets.

- Order Routing: Brokers that use advanced order routing technology and direct market access (DMA) can help minimize slippage by executing trades quickly and efficiently.

- Liquidity Providers: Brokers that have relationships with multiple liquidity providers can offer better pricing and tighter spreads, reducing the potential for slippage.

Best Practices for Managing Slippage in Volatile Markets

In addition to the tips mentioned above, several best practices can help traders effectively manage slippage in volatile markets:

- Diversify Trading Strategies: Diversifying trading strategies and asset classes can help spread risk and reduce the impact of slippage on overall trading performance.

- Use Risk Management Tools: Implementing robust risk management techniques, such as setting stop-loss orders and position sizing, can help mitigate the impact of slippage on trading accounts.

- Stay Informed: Keeping abreast of market developments, news events, and economic releases can help traders anticipate potential slippage and adjust their trading strategies accordingly.

Tools and Strategies to Reduce Slippage in Forex Trading

Tools and Strategies to Reduce Slippage in Forex Trading

Slippage is a common concern for forex traders, especially during periods of high volatility or low liquidity. Fortunately, several tools and strategies can be employed to mitigate the impact of slippage and improve trading outcomes. Here are some effective tools and strategies to reduce slippage in forex trading:

- Automated Trading Systems:

Automated trading systems, also known as algorithmic or robotic trading systems, utilize pre-defined trading algorithms to execute trades automatically based on specific criteria and parameters. These systems can help eliminate human error and emotions from trading decisions, leading to more consistent and disciplined execution.

Automated trading systems are particularly effective at reducing slippage because they can execute trades with precision and speed, minimizing delays between order placement and execution. By reacting quickly to market conditions and executing trades at optimal price levels, automated trading systems can help traders minimize slippage and maximize trading efficiency.

- Price Aggregation:

Price aggregation technology allows forex brokers to consolidate liquidity from multiple sources, including banks, financial institutions, and liquidity providers, to offer traders access to the best available prices in the market. By aggregating liquidity from multiple sources, brokers can reduce the likelihood of slippage and ensure that traders receive competitive pricing on their trades.

Price aggregation works by scanning the market for the most favorable prices and executing trades at the best available price levels. This helps minimize the impact of slippage by ensuring that trades are filled at prices that closely match the trader’s desired execution price. Additionally, price aggregation can help improve liquidity and reduce spreads, further enhancing trading conditions for traders.

- Slippage Controls:

Some trading platforms and brokers offer slippage controls that allow traders to set maximum deviation parameters for order execution. These controls enable traders to specify the maximum allowable deviation from the requested price at which an order can be executed. If the price deviates beyond the specified threshold, the order will not be executed, helping to limit the impact of slippage on trades.

Slippage controls are particularly useful for traders who are concerned about the potential impact of slippage on their trading outcomes. By setting maximum deviation parameters, traders can ensure that their trades are executed within acceptable price ranges, reducing the risk of unexpected slippage-related losses.

In conclusion, employing tools and strategies such as automated trading systems, price aggregation, and slippage controls can help forex traders reduce slippage and improve trading efficiency. By leveraging technology and implementing risk management measures, traders can minimize the impact of slippage on their trading outcomes and achieve greater success in the forex market.

Case Studies: Successful Traders Who Have Mastered Slippage

Several successful traders have effectively managed slippage in their trading strategies:

Learning from the experiences of successful traders can provide valuable insights into effective strategies for managing slippage in forex trading. Two prominent traders who have demonstrated mastery in navigating slippage and volatile market conditions are George Soros and Paul Tudor Jones.

- George Soros:

George Soros is a legendary investor and hedge fund manager renowned for his prowess in forex trading and risk management. Throughout his career, Soros has successfully navigated volatile markets and managed slippage with remarkable skill. One of Soros’s most notable achievements was his historic shorting of the British pound in 1992, known as “Black Wednesday.”

During the Black Wednesday currency crisis, Soros and his Quantum Fund famously bet against the pound sterling, anticipating its eventual devaluation. As the pound came under intense selling pressure, Soros capitalized on the opportunity, executing trades with precision to maximize profits while managing slippage effectively.

Soros’s success in managing slippage during the Black Wednesday crisis can be attributed to several key factors:

- Thorough Analysis: Soros conducted thorough analysis of market fundamentals, including economic data, central bank policies, and geopolitical developments, to inform his trading decisions and anticipate potential slippage.

- Adaptive Strategy: Soros remained flexible and adaptive in his trading strategy, adjusting his positions and risk exposure in real-time to mitigate the impact of slippage and capitalize on market opportunities.

- Disciplined Execution: Soros executed trades with discipline and precision, carefully timing his entries and exits to minimize slippage and maximize profitability.

By leveraging his analytical prowess, adaptability, and disciplined approach to execution, George Soros exemplified effective slippage management in forex trading.

- Paul Tudor Jones:

Paul Tudor Jones is a highly successful hedge fund manager known for his expertise in navigating volatile markets and minimizing slippage through meticulous analysis and execution. Jones’s trading career has been marked by several notable achievements, including his prescient predictions of market trends and his ability to capitalize on price inefficiencies.

One of Jones’s most renowned trades was his prediction of the 1987 stock market crash, where he successfully positioned his fund to profit from the ensuing market turmoil. Despite the extreme volatility and potential for slippage during the crash, Jones managed to execute trades effectively, minimizing losses and capitalizing on the market downturn.

Jones’s success in managing slippage can be attributed to several key strategies:

- Risk Management: Jones prioritized risk management in his trading approach, employing techniques such as position sizing, stop-loss orders, and portfolio diversification to mitigate the impact of slippage and preserve capital.

- Tactical Execution: Jones demonstrated tactical execution in his trading, carefully timing his entries and exits to minimize slippage and optimize profitability, particularly during periods of heightened market volatility.

- Adaptive Strategies: Jones remained adaptable in his trading strategies, adjusting his approach based on changing market conditions and emerging opportunities to effectively manage slippage and capitalize on market inefficiencies.

By integrating rigorous risk management, tactical execution, and adaptive strategies into his trading approach, Paul Tudor Jones has achieved remarkable success in managing slippage and navigating volatile market conditions.

In conclusion, the case studies of George Soros and Paul Tudor Jones highlight the importance of effective slippage management in forex trading. By applying rigorous analysis, disciplined execution, and adaptive strategies, successful traders can minimize the impact of slippage and capitalize on market opportunities, ultimately achieving long-term trading success.

Common Mistakes to Avoid When Dealing with Slippage

Common Mistakes to Avoid When Dealing with Slippage

Slippage is a common occurrence in forex trading, but it can be managed effectively with the right strategies and precautions. However, many traders fall victim to common mistakes that exacerbate the impact of slippage on their trading outcomes. To minimize the risk of slippage-related losses, traders should be aware of these mistakes and take proactive measures to avoid them. Here are two common mistakes to avoid when dealing with slippage:

- Neglecting Risk Management:

One of the most critical mistakes traders can make when dealing with slippage is neglecting proper risk management techniques. Risk management is essential in forex trading, particularly in volatile markets where slippage is more prevalent. Failing to implement effective risk management strategies can expose traders to significant losses and erode their trading capital.

Effective risk management involves several key principles, including:

a. Position Sizing: Properly sizing positions based on account size, risk tolerance, and trading strategy can help limit the impact of slippage on trading accounts. Traders should avoid allocating too much capital to any single trade, as this increases the potential for significant losses in the event of slippage.

b. Stop-Loss Orders: Placing stop-loss orders at appropriate levels can help traders limit their potential losses in the event of adverse price movements or slippage. Stop-loss orders act as a safety net, automatically closing out trades when predetermined price levels are reached to prevent further losses.

c. Diversification: Diversifying trading portfolios across different asset classes, currency pairs, and trading strategies can help spread risk and mitigate the impact of slippage on overall trading performance. By avoiding over-concentration in any single position or asset, traders can reduce their vulnerability to slippage-related losses.

Neglecting risk management exposes traders to unnecessary risks and compromises their long-term trading success. By prioritizing risk management and implementing appropriate risk mitigation strategies, traders can safeguard their trading capital and minimize the impact of slippage on their trading outcomes.

- Overleveraging:

Another common mistake that traders make when dealing with slippage is using excessive leverage. Leverage allows traders to control larger positions with a relatively small amount of capital, amplifying both potential gains and losses. While leverage can magnify profits in favorable market conditions, it also increases the risk of significant losses, especially in the presence of slippage.

Using excessive leverage exacerbates the impact of slippage on trading accounts, as larger positions are more susceptible to slippage-related losses. Traders who overleverage their positions may find themselves facing margin calls or forced liquidations if slippage results in substantial losses that exceed their available margin.

To avoid overleveraging, traders should:

a. Exercise prudence when selecting leverage ratios, taking into account their risk tolerance, trading strategy, and market conditions.

b. Avoid allocating too much leverage to any single trade, as this increases the risk of catastrophic losses in the event of slippage.

c. Regularly monitor and adjust leverage levels based on changes in market conditions, account performance, and risk appetite.

By using leverage judiciously and avoiding excessive leverage, traders can reduce their vulnerability to slippage-related losses and protect their trading capital.

In conclusion, avoiding common mistakes such as neglecting risk management and overleveraging is essential for dealing with slippage effectively in forex trading. By implementing robust risk management strategies and exercising prudence with leverage, traders can minimize the impact of slippage on their trading outcomes and improve their chances of long-term success in the forex market.

Conclusion and Key Takeaways

In conclusion, slippage is a common phenomenon in forex trading that can have a significant impact on trading outcomes, especially in volatile markets. By understanding the causes of slippage, implementing best practices for minimizing its impact, choosing the right broker, and avoiding common mistakes, traders can effectively manage slippage and improve their overall trading performance. With careful planning, risk management, and execution, traders can navigate the challenges of slippage and achieve success in the dynamic world of forex trading.

Read our latest article on Forex Swap

FAQs

- What is slippage in forex trading?Answer: Slippage refers to the difference between the expected price of a trade and the price at which it is actually executed. It often occurs during periods of high volatility or low liquidity in the market.

- Why is slippage a concern for forex traders?Answer: Slippage can lead to unexpected losses or reduced profits for traders, as trades are executed at less favorable prices than anticipated. It is a common occurrence in fast-moving market conditions.

- How can automated trading systems help reduce slippage?Answer: Automated trading systems execute trades automatically based on pre-defined criteria and parameters, eliminating human error and emotions from trading decisions. They can execute trades with precision and speed, minimizing delays and reducing the likelihood of slippage.

- What is price aggregation and how does it reduce slippage?Answer: Price aggregation technology consolidates liquidity from multiple sources to offer traders access to the best available prices in the market. By scanning the market for favorable prices and executing trades at optimal levels, price aggregation helps minimize the impact of slippage.

- What are slippage controls and how do they work?Answer: Slippage controls allow traders to set maximum deviation parameters for order execution. If the price deviates beyond the specified threshold, the order will not be executed, helping to limit the impact of slippage on trades.

- Why is risk management important in reducing slippage?Answer: Effective risk management techniques, such as position sizing, stop-loss orders, and portfolio diversification, can help mitigate the impact of slippage on trading outcomes. By managing risk effectively, traders can protect their capital and minimize losses.

- How can traders use leverage to reduce slippage?Answer: While leverage can amplify both profits and losses, using excessive leverage can increase the risk of slippage-related losses. Traders should use leverage judiciously and avoid over-leveraging to minimize the impact of slippage.

- What role do liquidity providers play in reducing slippage?Answer: Liquidity providers supply liquidity to the market, helping to ensure that trades can be executed quickly and efficiently at competitive prices. By offering access to deep liquidity pools, liquidity providers help reduce slippage for traders.

- Can slippage be entirely eliminated from forex trading?Answer: While slippage cannot be entirely eliminated, traders can take steps to minimize its impact on their trading outcomes. By employing risk management techniques, using appropriate tools and strategies, and trading during optimal market conditions, traders can reduce the likelihood of slippage.

- How can traders evaluate a broker’s ability to reduce slippage?Answer: Traders can evaluate a broker’s ability to reduce slippage by assessing factors such as execution speed, order routing technology, liquidity providers, and the availability of risk management tools such as slippage controls. By choosing a reputable broker with advanced technology and competitive pricing, traders can minimize slippage and improve their overall trading experience.

Click here to read more on Forex Slippage