Introduction

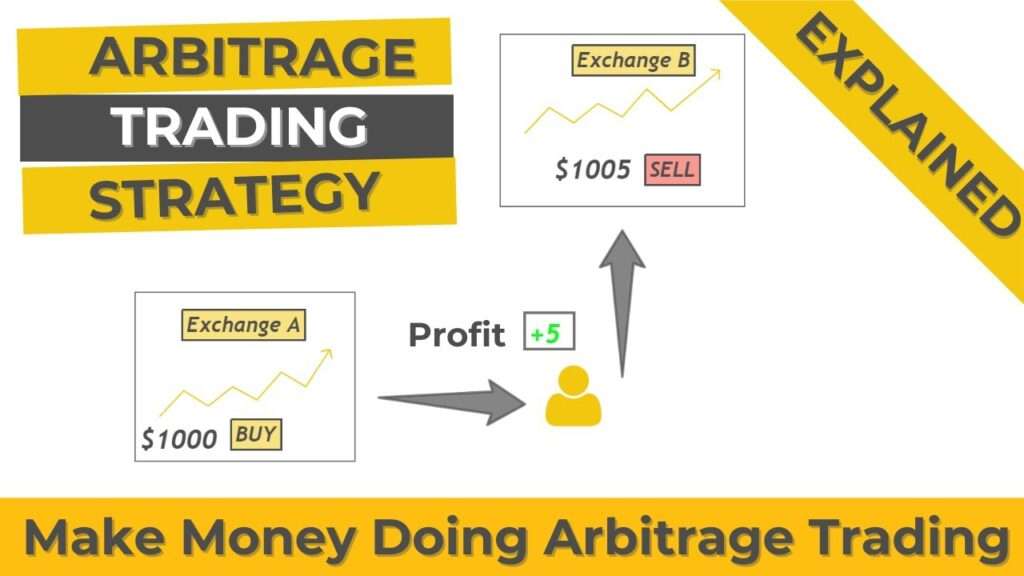

In the fast-paced world of forex trading, the pursuit of profit often leads traders to explore various strategies and techniques. One such strategy that has garnered attention for its potential to exploit market inefficiencies is arbitrage trading. Forex Arbitrage involves taking advantage of price discrepancies of the same asset in different markets or platforms to lock in profits.

In the realm of forex trading, arbitrage presents unique opportunities and challenges that require a deep understanding and careful execution. In this article, we will delve into the intricacies of arbitrage forex trading, exploring its types, risks, strategies, and tools to help you determine if it’s the right approach for your trading endeavors.

Understanding Market Inefficiencies

Forex markets are renowned for their high liquidity and efficiency, facilitating the seamless exchange of currencies around the clock. However, despite their efficiency, forex markets are not immune to inefficiencies. These inefficiencies can manifest in various forms, creating opportunities for astute traders to capitalize on price differentials and generate profits through arbitrage.

One common source of market inefficiency is network latency. In today’s digital age, where trading is conducted electronically, the speed at which information travels can impact the timeliness of trade execution. Network latency refers to the delay or lag in transmitting data between different points in a network. This delay can occur due to factors such as physical distance, network congestion, and processing time.

As a result, prices may update at different rates across various trading platforms or geographical locations, leading to temporary discrepancies in currency prices. Traders who can exploit these latency-related inefficiencies can execute trades at favorable prices before the market adjusts, thereby profiting from the price differentials.

Furthermore, differences in trading platforms can also contribute to market inefficiencies. Forex trading occurs across a multitude of platforms, each with its own set of features, order types, and pricing mechanisms. Variations in how these platforms handle orders, aggregate liquidity, and execute trades can lead to discrepancies in currency prices.

For instance, one platform may offer tighter spreads or faster execution speeds than another, creating opportunities for arbitrage. Traders adept at navigating these platform-specific inefficiencies can capitalize on price differentials by simultaneously buying and selling currencies across multiple platforms to lock in profits.

Types of Forex Arbitrage Trading

Arbitrage in forex trading encompasses several strategies, each designed to exploit specific market inefficiencies and generate profits. Let’s delve deeper into the various types of arbitrage commonly employed by forex traders:

- Triangular Arbitrage:

Triangular arbitrage involves capitalizing on price inconsistencies among three currency pairs to lock in risk-free profits. This strategy relies on the principle of cross-rate arbitrage, where the exchange rates between three currencies imply a fourth rate that differs from the actual market rate. By simultaneously buying and selling currencies across these three pairs, traders can exploit these discrepancies to earn arbitrage profits without exposing themselves to market risk. For example, if EUR/USD, USD/JPY, and EUR/JPY exchange rates do not align perfectly, a trader can execute a series of trades to profit from the pricing inefficiencies.

- Statistical Arbitrage:

Statistical arbitrage relies on quantitative models and statistical analysis to identify mispriced currencies based on historical data patterns. This strategy involves analyzing vast amounts of market data to uncover relationships and correlations between different currency pairs. By identifying deviations from historical norms or statistical anomalies, traders can pinpoint potential arbitrage opportunities and exploit them for profit. Statistical arbitrage strategies often involve sophisticated algorithms and automated trading systems to analyze data in real-time and execute trades swiftly.

- Latency Arbitrage:

Latency arbitrage capitalizes on the time lag between price updates across different trading platforms to execute trades at advantageous prices. In today’s fast-paced electronic trading environment, even the slightest delay in data transmission can create pricing disparities between platforms. By leveraging high-speed trading infrastructure and proximity to exchange servers, traders can exploit these latency-related inefficiencies to gain a competitive edge. Latency arbitrage strategies involve monitoring multiple trading venues simultaneously and executing trades rapidly to capitalize on fleeting price differentials before they converge.

- Cross-Currency Arbitrage:

Cross-currency arbitrage seizes opportunities arising from pricing disparities between related currency pairs. This strategy involves identifying discrepancies in the exchange rates of currency pairs that share a common currency. For example, if EUR/USD and EUR/GBP exchange rates deviate from the implied cross-rate between USD/GBP, a trader can exploit these differences by simultaneously buying and selling the currencies involved. Cross-currency arbitrage requires careful monitoring of multiple currency pairs and quick execution to capitalize on price differentials before they normalize.

In summary, the various types of arbitrage in forex trading offer traders diverse opportunities to profit from market inefficiencies. Whether it’s exploiting triangular relationships, leveraging statistical models, capitalizing on latency advantages, or identifying cross-rate disparities, arbitrage strategies require a combination of analytical skills, technological infrastructure, and swift execution to succeed in the dynamic forex market environment.

Risks and Challenges of Arbitrage Forex Trading

- Execution Risk:

Execution risk refers to the possibility that rapid price movements or delays in order processing can erode potential profits or even result in losses for arbitrage traders. In the fast-paced forex market, where prices can fluctuate within milliseconds, the timely execution of trades is crucial. However, factors such as network latency, platform inefficiencies, or order processing delays can hinder the seamless execution of trades.

As a result, traders may miss out on arbitrage opportunities or face losses if prices move unfavorably before their orders are filled. Mitigating execution risk requires traders to utilize advanced trading technology, employ robust risk management strategies, and maintain vigilant monitoring of market conditions.

- Counterparty Risk:

Arbitrage trading often involves reliance on multiple brokers or liquidity providers to access different trading platforms and execute trades across various markets. This dependence exposes traders to counterparty risk—the risk that one or more counterparties may default on their obligations or become insolvent. In the event of broker insolvency or liquidity provider default, traders may face challenges in recovering their funds or completing trades, leading to potential losses.

To mitigate counterparty risk, traders should conduct thorough due diligence when selecting brokers or liquidity providers, diversify their exposure across multiple counterparties, and monitor the financial stability of their trading partners.

- Regulatory Risk:

Arbitrage strategies may encounter regulatory restrictions or scrutiny in certain jurisdictions, posing a significant risk to traders. Regulatory authorities impose rules and guidelines to maintain market integrity, prevent manipulation, and safeguard investor interests. However, arbitrage trading strategies that exploit pricing inefficiencies may inadvertently violate regulatory requirements, particularly in jurisdictions with strict market manipulation laws or restrictions on certain trading practices.

Traders must stay informed about regulatory developments, understand the regulatory landscape in which they operate, and ensure compliance with relevant laws and regulations to mitigate regulatory risk. Failure to comply with regulatory requirements can result in penalties, fines, or even the suspension of trading privileges.

- Technology Risk:

Arbitrage trading relies heavily on high-speed trading infrastructure, including advanced trading platforms, data feeds, and network connectivity. However, this reliance exposes traders to technology risk—the risk of technical glitches, system failures, or disruptions that can impede trade execution and profitability. Technical issues such as server outages, connectivity problems, or software bugs can disrupt arbitrage operations and lead to missed opportunities or losses.

To mitigate technology risk, traders should invest in robust and redundant infrastructure, implement backup systems, and stay vigilant for potential issues that may affect trading performance. Additionally, ongoing monitoring and maintenance of trading technology are essential to minimize the impact of technology-related disruptions.

In summary, arbitrage forex trading offers the potential for profits by exploiting pricing differentials in the market. However, traders must be aware of the inherent risks and challenges associated with arbitrage trading, including execution risk, counterparty risk, regulatory risk, and technology risk. By implementing rigorous risk management practices, conducting thorough due diligence, and staying informed about market dynamics and regulatory developments, traders can mitigate these risks and enhance their chances of success in arbitrage forex trading.

Key Strategies for Successful Arbitrage Trading

To navigate the complexities of arbitrage forex trading effectively, traders should adopt the following strategies:

- Robust Risk Management: Implement stringent risk controls to mitigate potential losses and preserve capital.

- Advanced Technology: Invest in cutting-edge trading technology and infrastructure to minimize latency and optimize execution speed.

- Diversification: Spread arbitrage trades across multiple currency pairs, brokers, and geographic regions to diversify risk exposure.

- Continuous Monitoring: Stay vigilant and monitor market conditions in real-time to capitalize on fleeting arbitrage opportunities.

- Adaptability: Remain flexible and adapt trading strategies to evolving market dynamics and regulatory landscapes.

Tools and Resources for Identifying Arbitrage Opportunities

Identifying arbitrage opportunities in the forex market requires access to sophisticated tools and resources that can analyze vast amounts of data and detect pricing discrepancies across different platforms. Here are some key tools and resources that traders can leverage to identify and capitalize on arbitrage opportunities:

- Algorithmic Trading Platforms:

Algorithmic trading platforms are automated systems equipped with sophisticated algorithms that can scan multiple markets simultaneously to pinpoint arbitrage opportunities. These platforms utilize advanced quantitative models and mathematical algorithms to analyze real-time market data, identify pricing disparities, and execute trades swiftly. Algorithmic trading platforms offer traders the advantage of speed, accuracy, and efficiency in identifying and capitalizing on arbitrage opportunities across various currency pairs and markets.

- Price Aggregators:

Price aggregators are platforms that consolidate pricing data from various sources, such as liquidity providers, exchanges, and trading platforms. These platforms enable traders to compare prices across different venues and identify discrepancies in currency prices.

Price aggregators offer traders transparency into market prices and facilitate the identification of arbitrage opportunities by highlighting differences in bid-ask spreads, order book depth, and liquidity levels across different platforms. By accessing pricing data from multiple sources, traders can make more informed trading decisions and capitalize on arbitrage opportunities efficiently.

- News Feeds and Market Analysis:

Staying informed about macroeconomic developments, central bank policies, and geopolitical events is crucial for identifying arbitrage opportunities in the forex market. News feeds and market analysis provide traders with insights into factors that can impact currency prices and create arbitrage opportunities.

By monitoring news headlines, economic indicators, and geopolitical developments, traders can anticipate market movements and position themselves to exploit pricing discrepancies that arise in response to news events. Additionally, conducting fundamental and technical analysis can help traders identify trends, patterns, and anomalies in currency prices that can be exploited for arbitrage trading.

- Historical Data Analysis:

Analyzing historical price data is a valuable tool for identifying recurring patterns and anomalies that can be exploited for arbitrage trading. By studying past market behavior, traders can identify correlations, trends, and inefficiencies that may persist in the future. Historical data analysis enables traders to backtest arbitrage strategies, validate trading models, and refine trading algorithms based on empirical evidence. By analyzing historical price data, traders can gain valuable insights into market dynamics and identify arbitrage opportunities with a higher probability of success.

In summary, traders can leverage a variety of tools and resources to identify arbitrage opportunities in the forex market. Algorithmic trading platforms, price aggregators, news feeds, market analysis, and historical data analysis are essential tools that provide traders with the insights and information needed to capitalize on pricing discrepancies and generate profits through arbitrage trading.

By utilizing these tools effectively, traders can enhance their ability to identify, evaluate, and execute arbitrage opportunities in the dynamic and competitive forex market.

Setting Up Your Arbitrage Forex Trading System

Establishing a robust arbitrage forex trading system requires careful planning and execution:

- Selecting Reliable Brokers: Choose reputable brokers with competitive pricing, deep liquidity, and reliable execution.

- Building Trading Infrastructure: Invest in high-speed internet connectivity, powerful hardware, and low-latency trading software to ensure swift order execution.

- Backtesting and Optimization: Validate trading strategies through rigorous backtesting using historical data and fine-tune parameters to optimize performance.

- Legal and Compliance Considerations: Familiarize yourself with regulatory requirements and ensure compliance with relevant laws and regulations in your jurisdiction.

Monitoring and Managing Your Arbitrage Trades

Active monitoring and effective risk management are essential for successful arbitrage trading:

- Real-Time Monitoring: Monitor price movements and execution status in real-time to identify and capitalize on arbitrage opportunities.

- Dynamic Position Sizing: Adjust position sizes based on market conditions, liquidity, and risk appetite to optimize returns and manage risk.

- Contingency Planning: Develop contingency plans to address unforeseen events, such as broker outages or market disruptions, to minimize potential losses.

- Regular Performance Review: Conduct periodic performance reviews to assess the effectiveness of trading strategies and identify areas for improvement.

Case Studies: Real-Life Examples of Successful Arbitrage Trades

To illustrate the practical application of arbitrage forex trading, let’s examine a couple of real-life case studies:

- Triangular Arbitrage: A trader identifies a pricing discrepancy among three currency pairs—EUR/USD, GBP/USD, and EUR/GBP—and executes a series of synchronized trades to exploit the arbitrage opportunity and lock in profits.

- Latency Arbitrage: By leveraging ultra-fast trading infrastructure and collocating servers in proximity to exchange servers, a high-frequency trader capitalizes on the time lag between price updates across different trading platforms to execute trades at favorable prices.

Conclusion: Is Arbitrage Forex Trading Right for You?

Arbitrage forex trading offers the potential for lucrative profits by exploiting market inefficiencies, but it requires sophisticated technology, rigorous risk management, and a deep understanding of market dynamics. Before venturing into arbitrage trading, assess your risk tolerance, trading expertise, and access to resources.

While arbitrage can be highly profitable for skilled traders, it’s not without risks, and success depends on careful planning, execution, and adaptation to changing market conditions. By employing sound strategies, leveraging advanced technology, and staying vigilant, you can navigate the complexities of arbitrage forex trading and potentially reap substantial rewards.

In conclusion, arbitrage forex trading presents a tantalizing opportunity for traders seeking to capitalize on price differentials in the global currency markets. However, success in arbitrage trading hinges on a combination of technological prowess, risk management discipline, and market acumen.

By understanding the types, risks, strategies, and tools associated with arbitrage forex trading, you can make informed decisions and determine if it aligns with your trading objectives and risk appetite.

Read our latest article on Diversification

FAQs

- What is arbitrage forex trading?

- Arbitrage forex trading involves exploiting price differences of the same currency pair across different markets or platforms to generate profits.

- Is arbitrage trading risk-free?

- While arbitrage trading may seem risk-free on paper, in reality, it comes with various risks and challenges, including execution risk, counterparty risk, regulatory risk, and technology risk.

- What are some common types of arbitrage in forex trading?

- Common types of arbitrage in forex trading include triangular arbitrage, statistical arbitrage, latency arbitrage, and cross-currency arbitrage.

- How can traders identify arbitrage opportunities?

- Traders can utilize tools such as algorithmic trading platforms, price aggregators, news feeds, market analysis, and historical data analysis to identify arbitrage opportunities.

- What is execution risk in arbitrage trading?

- Execution risk refers to the possibility that rapid price movements or delays in order processing can erode potential profits or lead to losses for arbitrage traders.

- What is counterparty risk, and how can it affect arbitrage traders?

- Counterparty risk arises from the possibility of default or insolvency of brokers or liquidity providers, which can expose traders to losses or challenges in completing trades.

- What regulatory risks are associated with arbitrage trading?

- Arbitrage strategies may run afoul of regulatory restrictions or scrutiny in certain jurisdictions, leading to potential penalties, fines, or trading restrictions for traders.

- How does technology risk impact arbitrage traders?

- Technology risk refers to the risk of technical glitches, system failures, or disruptions that can impede trade execution and profitability for arbitrage traders.

- What role do news feeds and market analysis play in identifying arbitrage opportunities?

- News feeds and market analysis provide traders with insights into macroeconomic developments, central bank policies, and geopolitical events that can impact currency prices and create arbitrage opportunities.

- Why is historical data analysis important for arbitrage trading?

- Historical data analysis enables traders to identify recurring patterns and anomalies in currency prices, backtest trading strategies, and refine trading algorithms based on empirical evidence, enhancing their ability to identify and exploit arbitrage opportunities.

Click here to read more on Arbitrage